Oxygen UI + Protocol (oxygen.org) overview

Pools

The core of Oxygen Prime Brokerage is the creation of Pools of multiple assets whereby Users can create custom Pools containing various Assets. Once the Pool is created, Assets can be lent out or borrowed. Interest is earned or paid. The really interesting thing is that instead of just depositing Assets and hoping for an increase in price, interest can be earned as well with limited risk due to the automated margining approach based on the LTV of the overall Portfolio rather than individual Assets. Furthermore, Assets can be borrowed which allows Users to get access to a certain token without requiring them to realize gains or losses in the Asset which serves as Collateral.

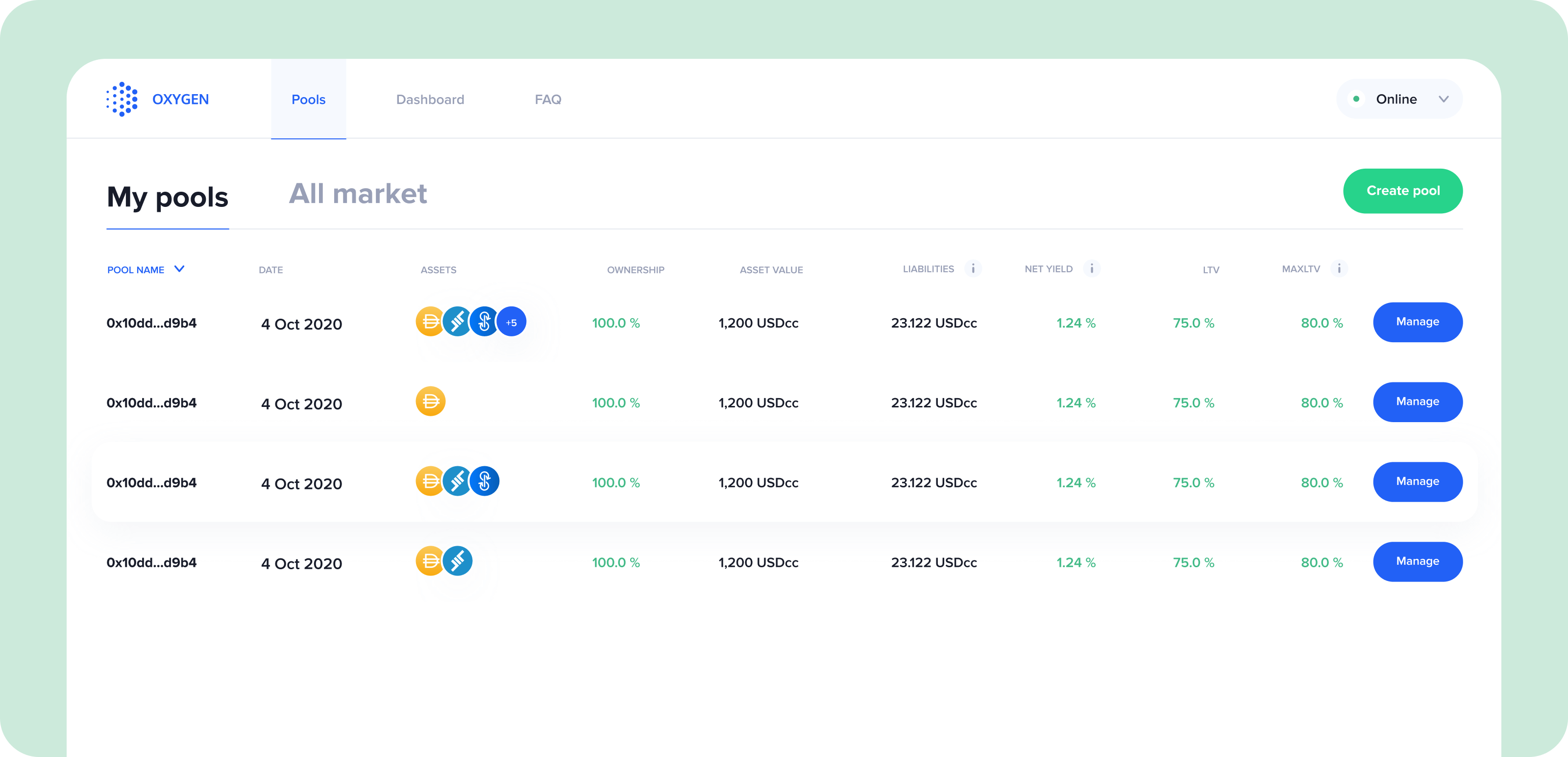

Pool Overview

This screen shows the overview of all the Pools belonging to a given User, the assets in each Pool and some high level KPIs.

The Columns shown above are as follows:

Pool Name

The Pool Name is the Address of a Smart Contract representing the Pool of Assets. It will only be accessible to the User who created it for a Private Pool.

Assets

Icons representing the tokens contained in the Pool.

Ownership

The percentage of a given Pool that the given User owns. For a Private Pool this will always be 100%. Initially there will only be Private Pools.

Asset Value

This represents the total amount of Assets held for deposit or lent out in USDc for the given Pool.

Liabilities

This represents the total amount of Debt (=Borrowings) in USDc for the given Pool.

Net Yield

This is the amount of interest accruing on a given Pool over a given period of time (daily, weekly, monthly, …). Borrowings will accrue negative interest and offset earnings from Lending.

LTV

LTV or Current LTV is the total amount of Debt (i.e. Borrowings) as a percentage of Total Assets (Assets plus Lending Amounts).

The formula is CLTV = Sum(DEBT_i) / (ASSET_i + IOU_i) for each Asset i in the Pool.

Max LTV

This is LTV over which liquidation/rebalancing of your Portolio will start. It may be slightly higher than Maintenance LTV to give you time to adjust your portfolio for a short period of time (for example [4] hours). This is future functionality and but will be available soon. In the meantime, Max LTV is the same as Maintenance LTV.

By pressing on Deposit you can add Assets to a given Pool and likewise by selecting Withdraw, you can withdraw some Assets.

Create a Pool

If you wish to create a Pool, click on Create Pool. You will be asked which Assets you wish to add to the Pool and how much of each. Assuming you have the Assets in your Wallet, you will be asked to confirm and then your Pool will be created. LTV calculations and as a result Buying Power calculations are done on the Pool as a whole.

Deposit Assets

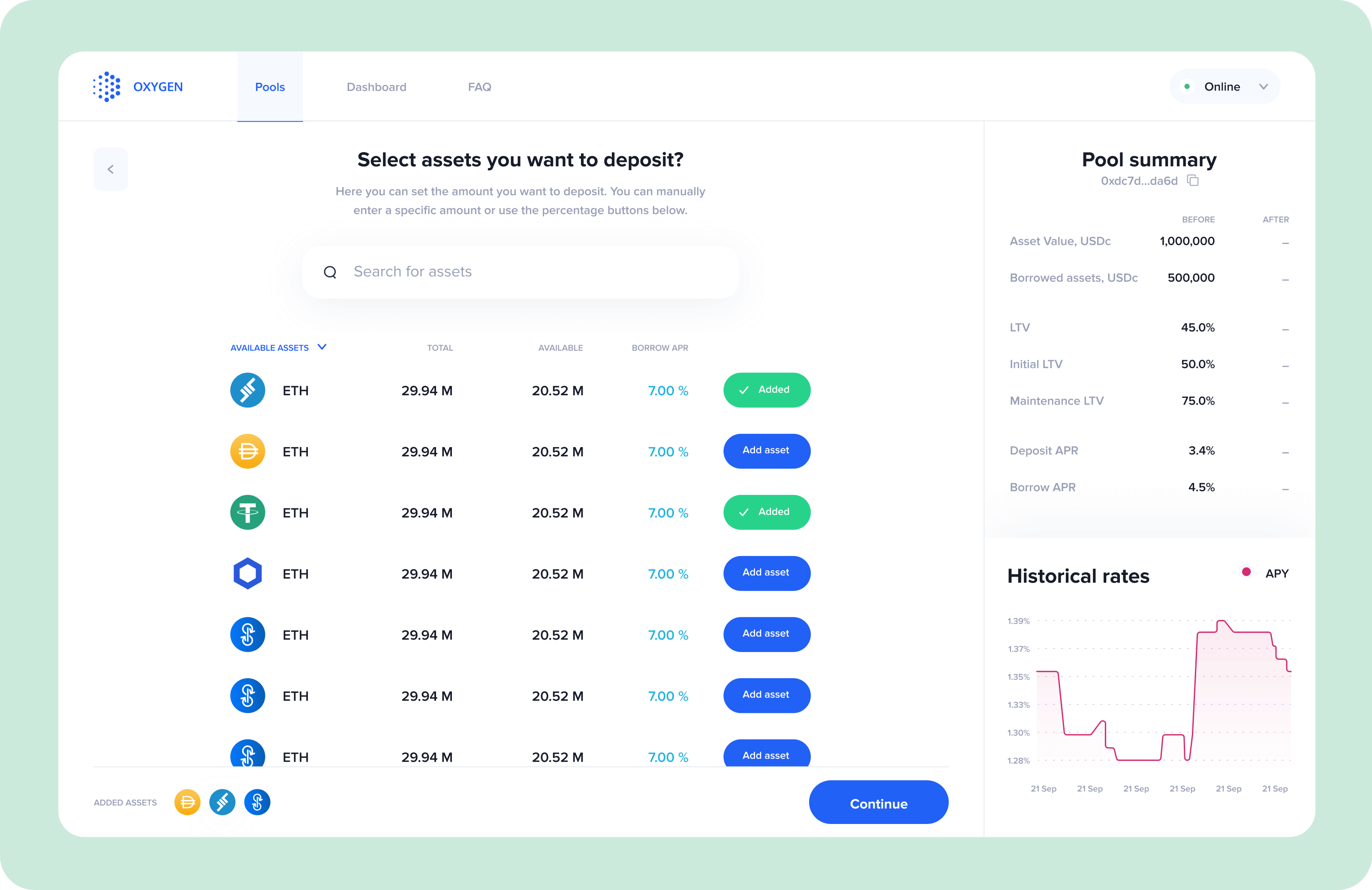

Select Assets to deposit

Let’s deposits assets in the pool. First, start by selecting the assets you want to deposit. You should be able to see which ones you have available in your wallet in a table with asset information.

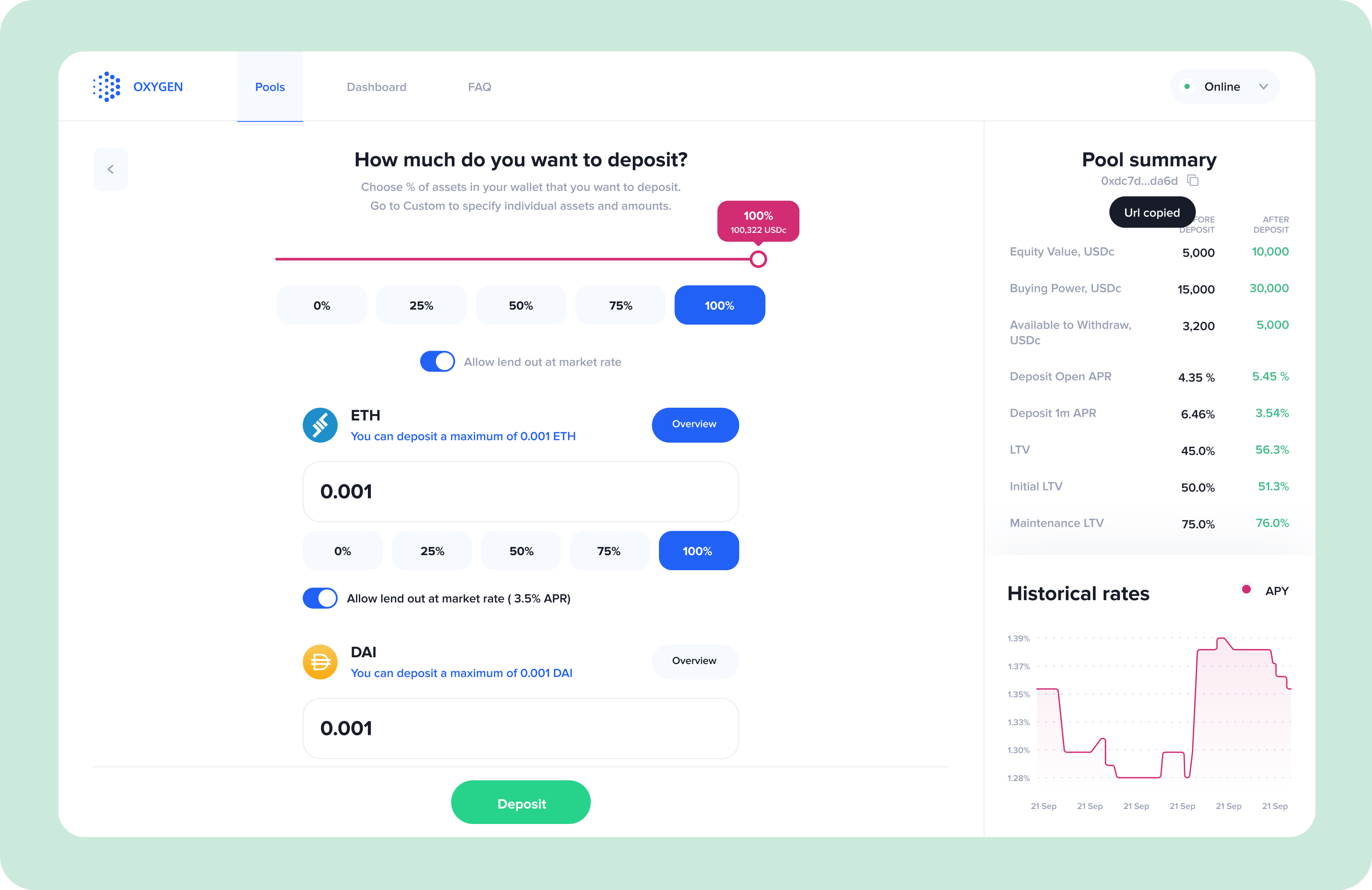

Deposit Assets

Second, select how much of the position held in your wallet in these assets you want to deposit - 0 - 100%. Alternatively, you can choose an custom amount for each asset. Third, select if you want to automatically lend-out your assets and start generating yield straight away. You will be able to amend this setting later.

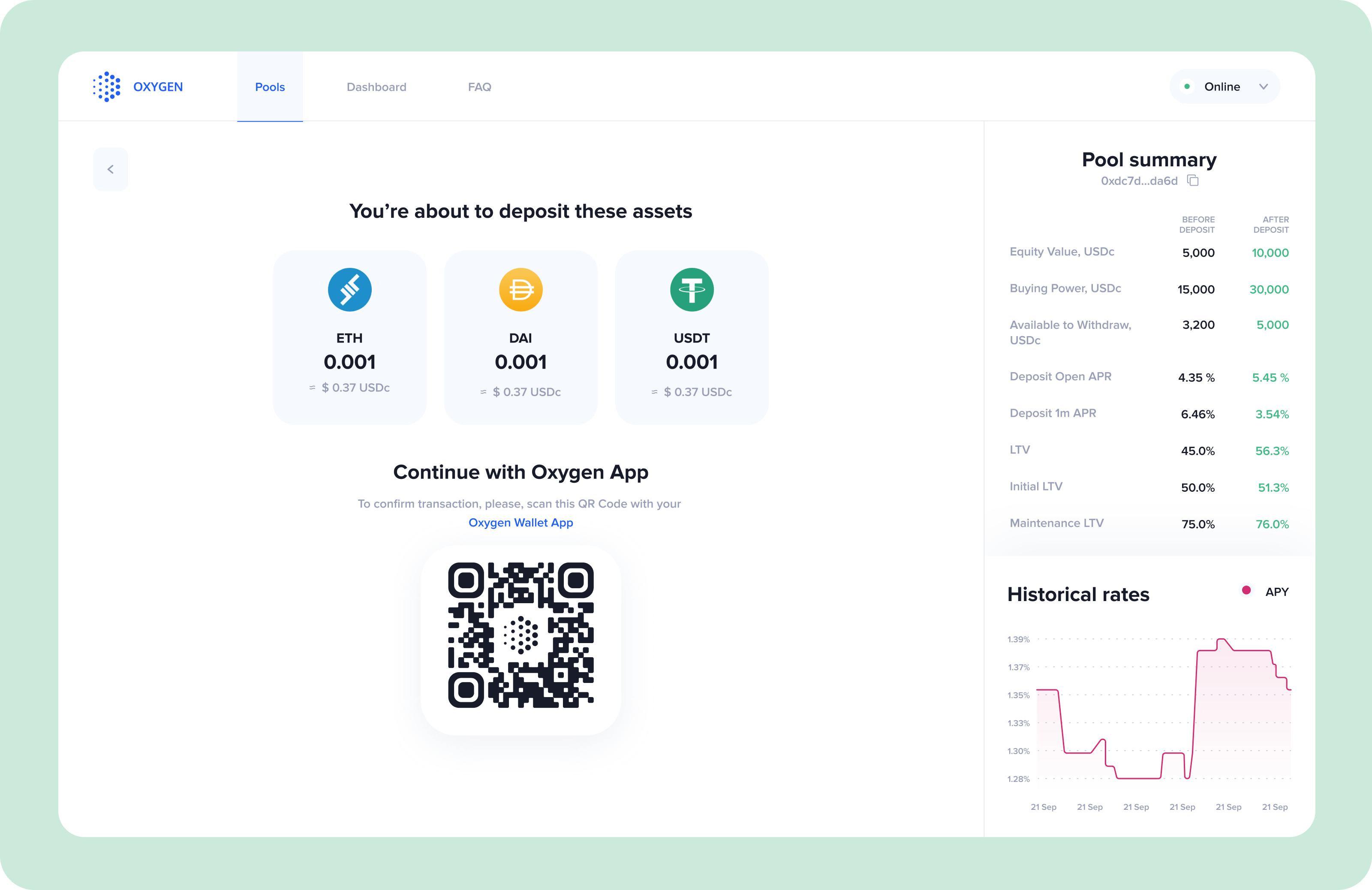

Confirm Asset Deposit

Before Assets are actually transferred, you have to confirm the transfer with the Oxygen App. The system shows a QR code which you scan with the App and then confirm.

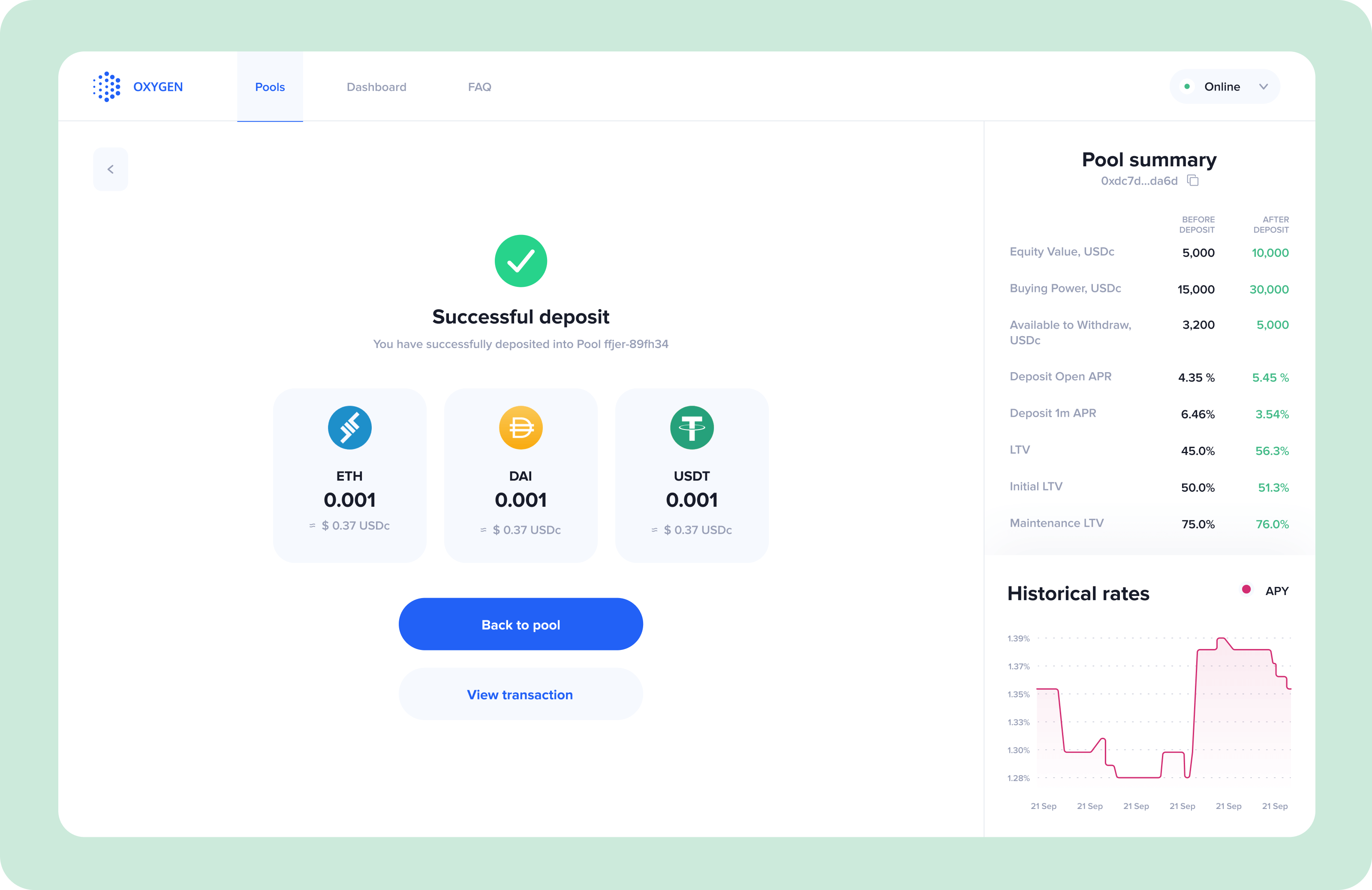

Asset Deposit Confirmation

When the Deposit is confirmed and the transaction is complete, you will get a confirmation that your funds have been deposited.

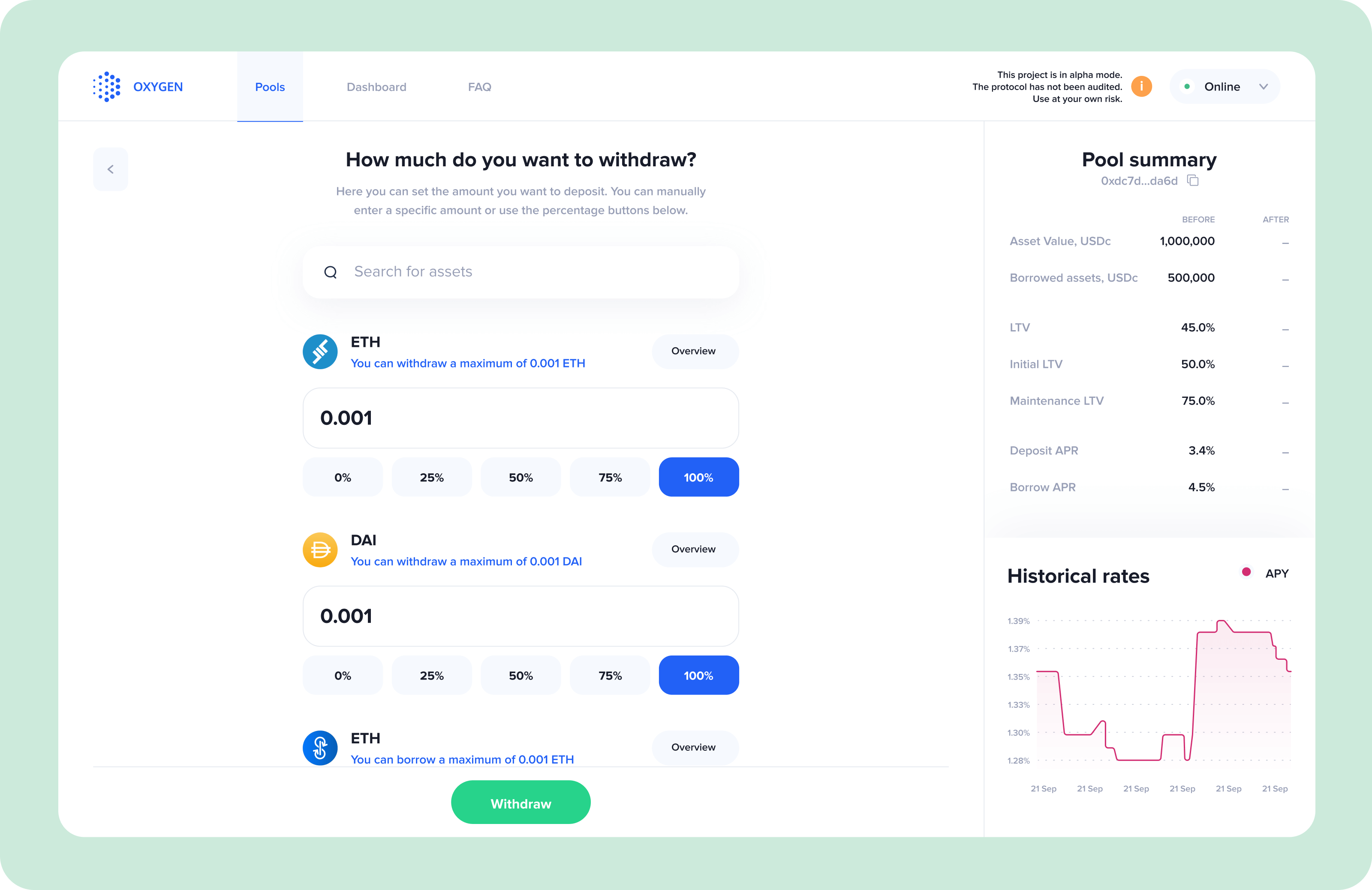

Withdraw Assets

Select Assets and Amounts to withdraw

Select how much from each Asset you would like to withdraw. For existing Pools, any withdrawal will default to the pro rata split of the current Asset composition of the Pool.

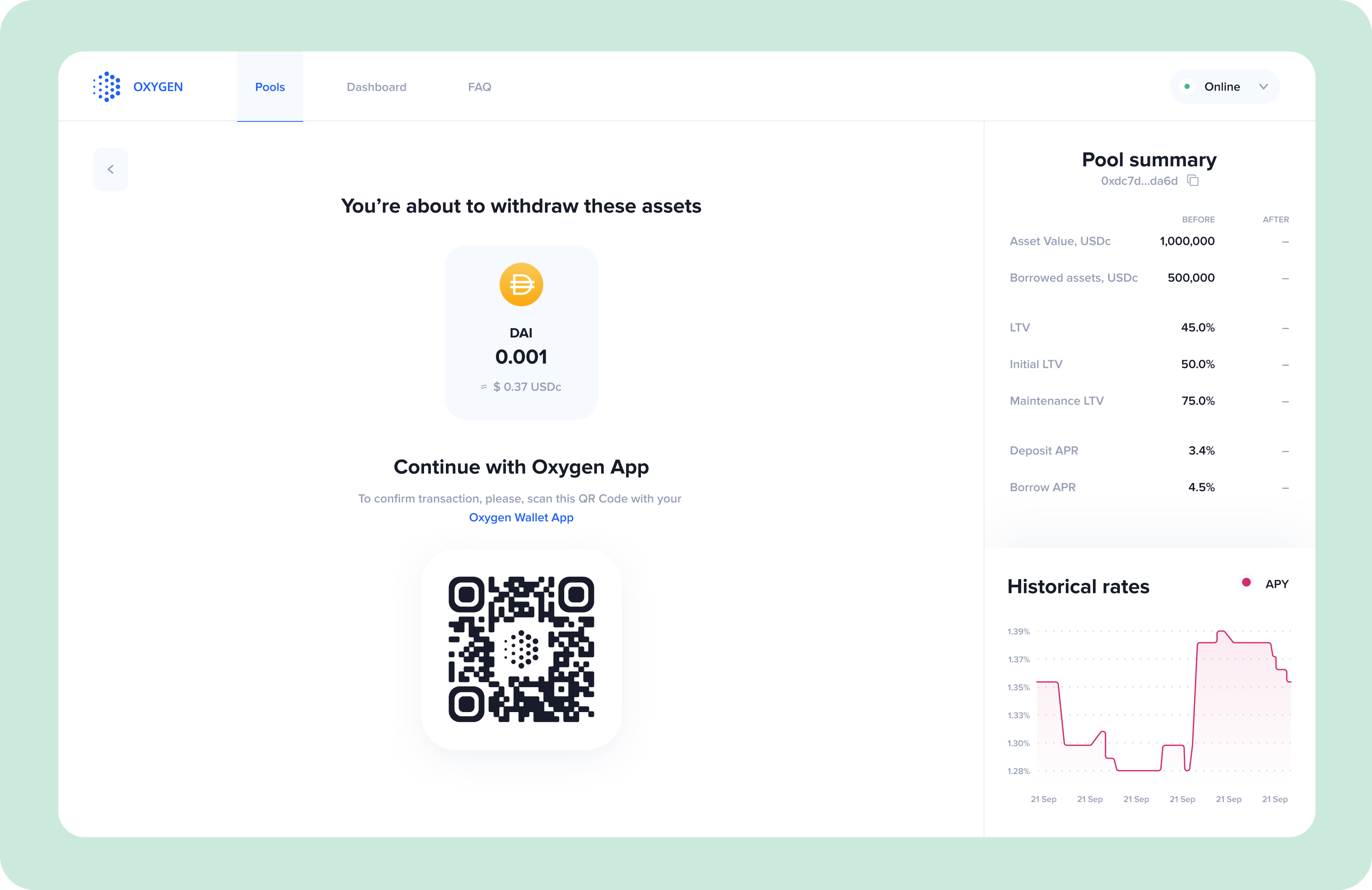

Confirm Withdrawal

Before Assets are actually withdrawn out of the Pool, you have to confirm the withdrawal with the Oxygen App. The system shows a QR code which you scan with the App and then confirm.

Asset Withdrawal Confirmation

When the Withdrawal is confirmed and the transaction is complete, you will get a confirmation that your funds have been withdrawn.

Borrowing

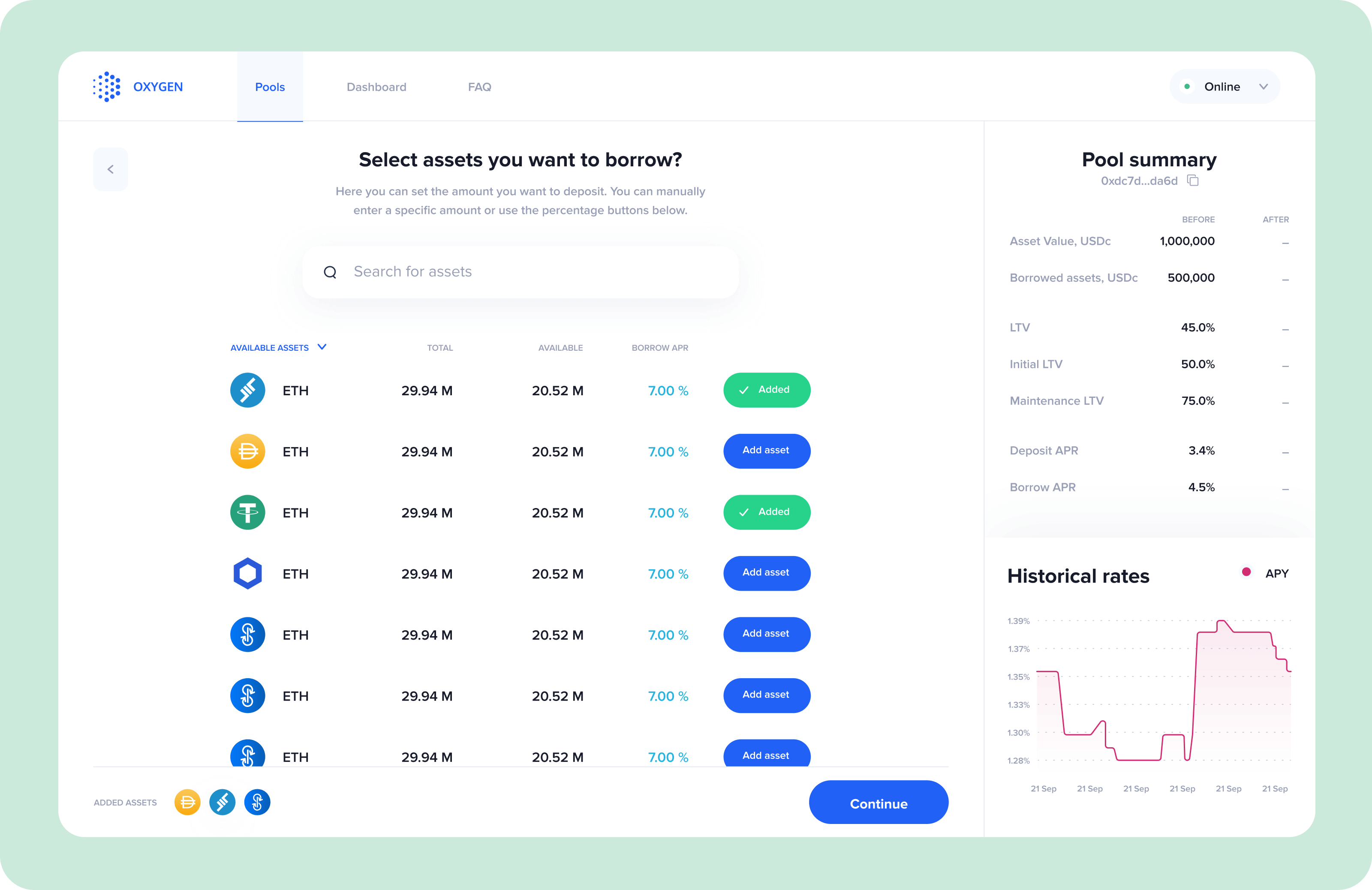

Select Assets to Borrow

If you would like to borrow assets, select assets from the available Assets in the Protocol. For each Asset type, you will see the total amount of the given Asset deposited in the protocol (TOTAL) and the total amount available for borrowing (AVAILABLE). In addition you see the interest rate charged for borrowing each asset (BORROW APR). Click “Add Asset” for any asset that you would like to borrow, they will then be marked as Added. This only means that they will be added to the list of Assets that you would like to borrow. Then click Continue.

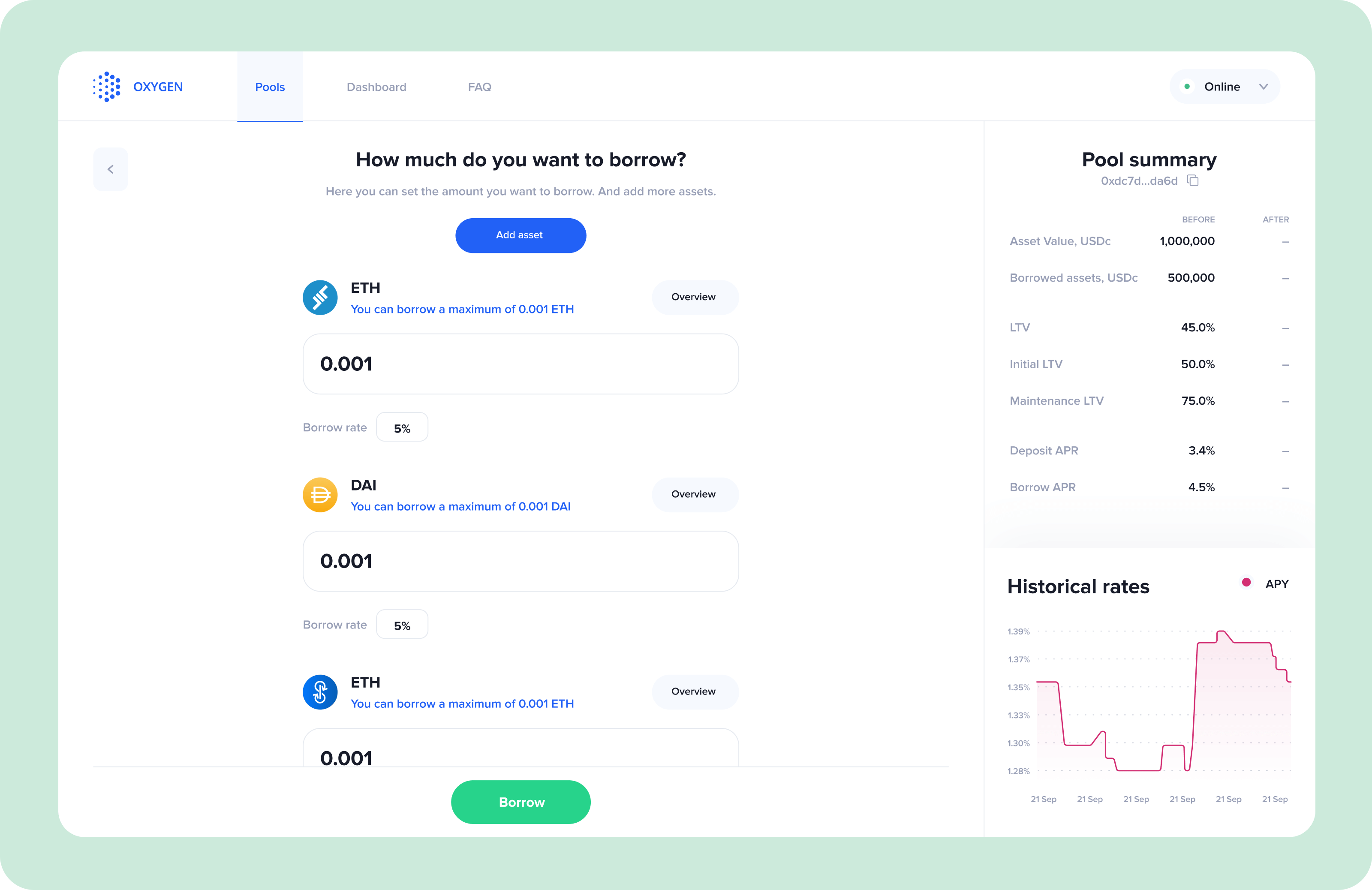

Set amount to borrow

On this screen, any Asset that you have selected to borrow will be listed. You can select how much of each Asset you would like to borrow up to the maximum.

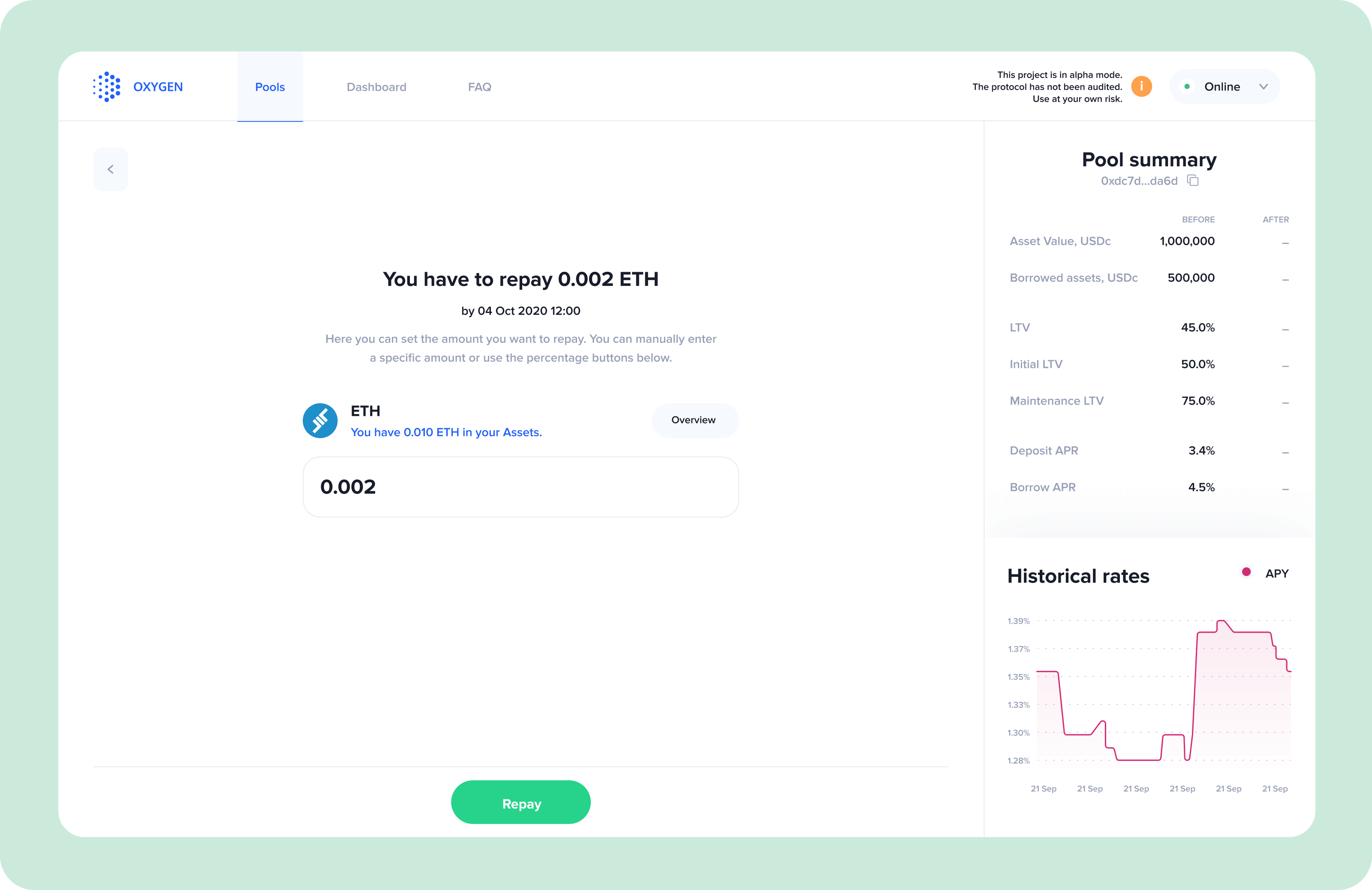

On the right side of the screen you will see key Pool Summary values.

Asset

The total amount of Assets in USDc held for deposit or lent out.

Borrowed Assets

This represents the Total Amount of Debt (=Borrowings) for the given Pool.

LTV

LTV or Current LTV is the total amount of Debt (i.e. Borrowings) as a percentage of Total Assets (Assets plus Lending Amounts).

The formula is CLTV = Sum(DEBT_i) / (ASSET_i + IOU_i) for each Asset i in the Pool.

Initial LTV

The Initial Loan-To-Value is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to take a new position (or after the Maintenance LTV resets).

Maintenance LTV

The Maintenance Loan-To-Value is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to maintain an existing position.

The Maintenance LTV applies for a certain number of hours (currently this is [24] hours) during which the Current LTV may be above the Initial LTV. At the end of the time period, the margin needs to be back down to the Initial LTV.

Buying Power

Buying Power is the maximum amount of equity available to borrow tokens.

Buying Power gives you additional leverage to borrow additional assets, increasing your access to assets but also increasing your risk.

Buying Power = Total Value of Assets * Initial LTV - Value of Debt = Total Value of Assets * (Initial LTV – Current LTV)

Deposit APR

Annual interest rate for deposits.

Borrow APR

Annual interest rate for borrowing.

You can also see historic rates over time for both borrowing and saving.

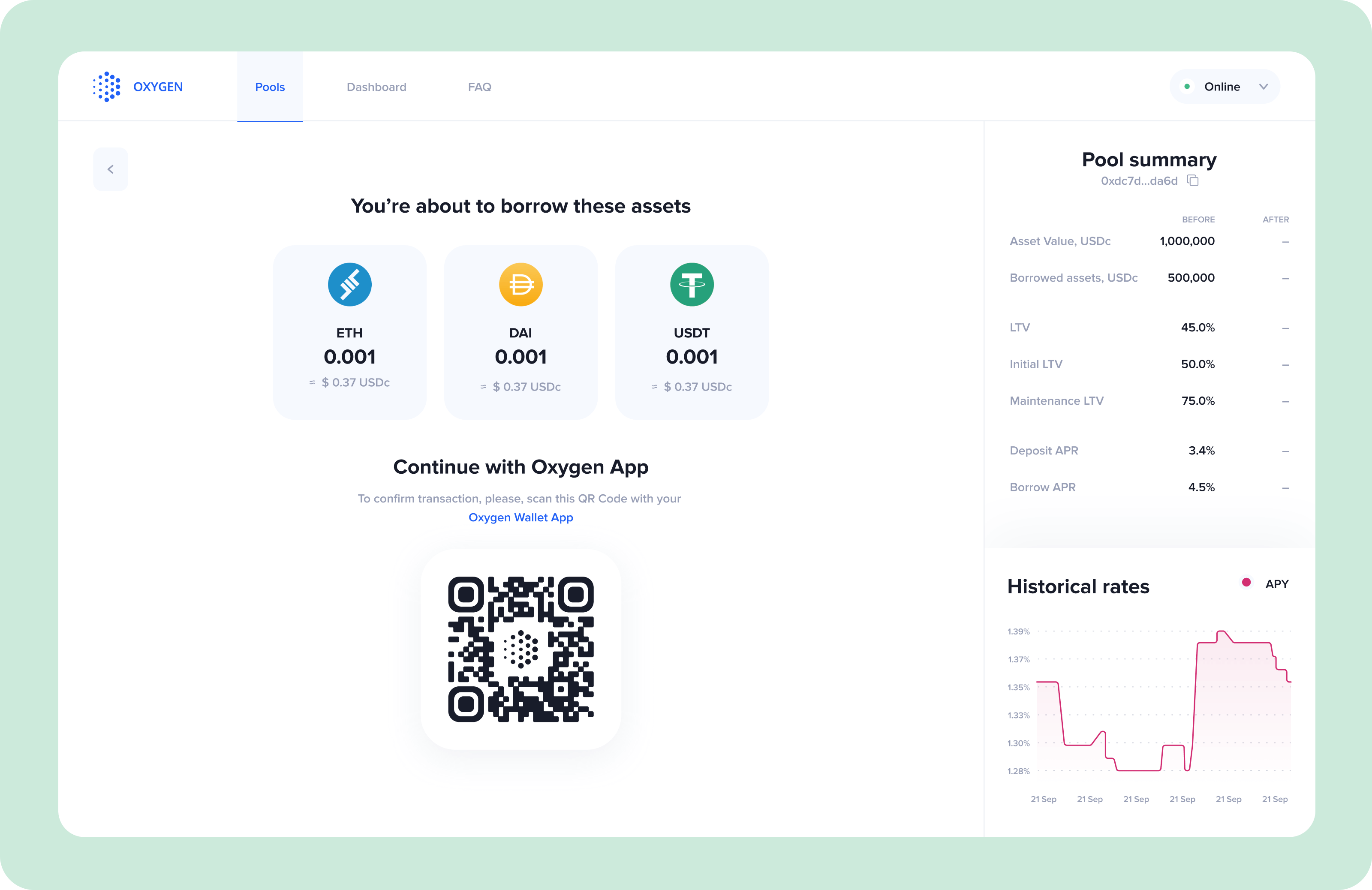

Confirm Assets to Borrow

Before Assets are actually borrowed, you have to confirm that you want to borrow the Assets selected with the Oxygen App. The system shows a QR code which you scan with the App and then confirm.

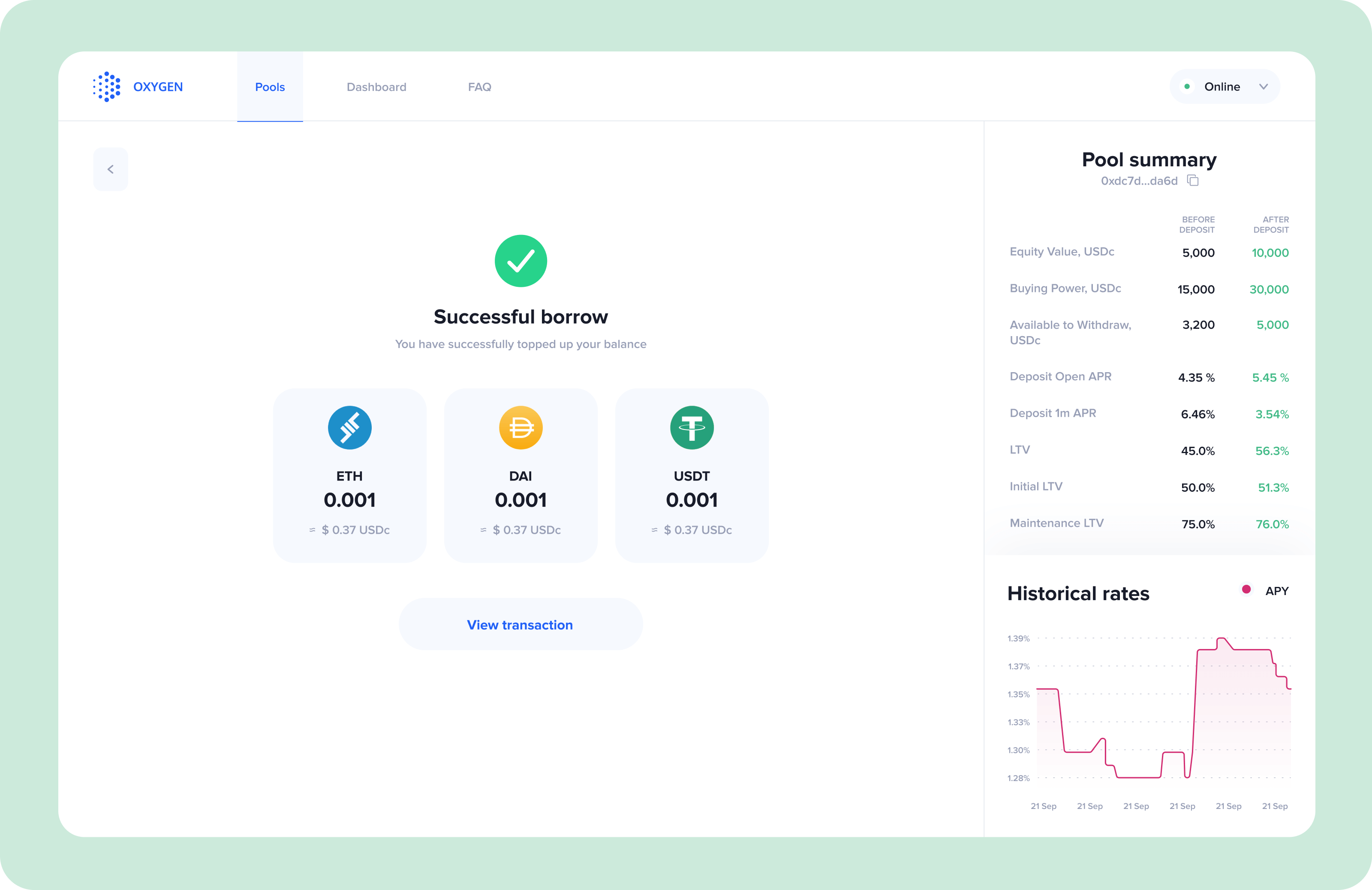

Borrowed Assets Confirmation

When the Borrowing is confirmed and the transaction is complete, you will get a confirmation that the Assets selected have been borrowed.

Set Borrowing Terms

For each Asset you wish to borrow, you need to set borrowing terms. This refers to the terms under which you are willing to borrow this Asset in this Pool. It can either be Market (whatever the market determined APR is by the orderbook) or Limit where you specify the Maximum Rate (APR) that you would be willing to pay.

Depending on what you select, your request to borrow will be matched with offers to lend in the orderbook.

Repay Loan

You can repay a loan at the end of the current interest period (usually 24 hours). The amount that you need to repay will be equal to the amount you borrowed plus any accrued interest. If you roll your position, the amount of interest due will be added to the amount of loan. This will also reduce your buying power and increase your LTV. You can also roll the loan for another 24 hour period. This happens automatically if you do not repay your loan.

If the LTV of your Pool becomes higher than the Initial LTV but is lower than the Maintenance LTV, there is no problem for a period of [24 hours] but after that you have to get the LTV of your Pool back to the Initial LTV by remaining some or all of your outstanding loans or depositing more Assets into the Pool.

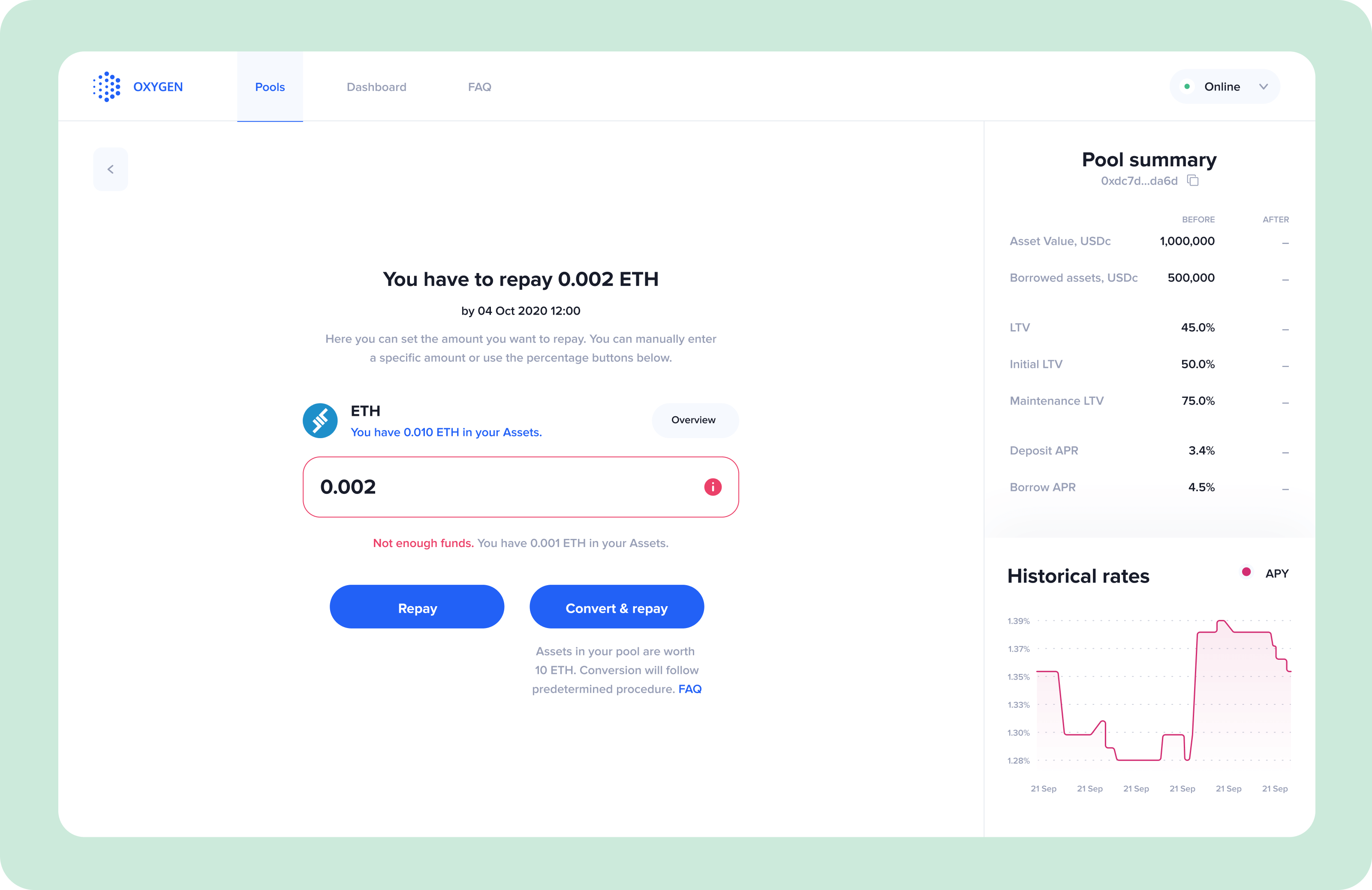

Not enough Funds

In the event that you do not have enough funds to repay the Loan or try to pay more than you have, the Protocol will give you an error message that you are out of funds. This can occur even if your LTV is fine if you have lent out all or most of your available assets. In that case, you have assets but no liquid assets. If this happens to you, you should either add more Assets or redeem some Loans.

Repayment Confirmed

When you do make a successful repayment, you will get a confirmation. You will also be asked if you would like to repay another Loan.

Managing Pools

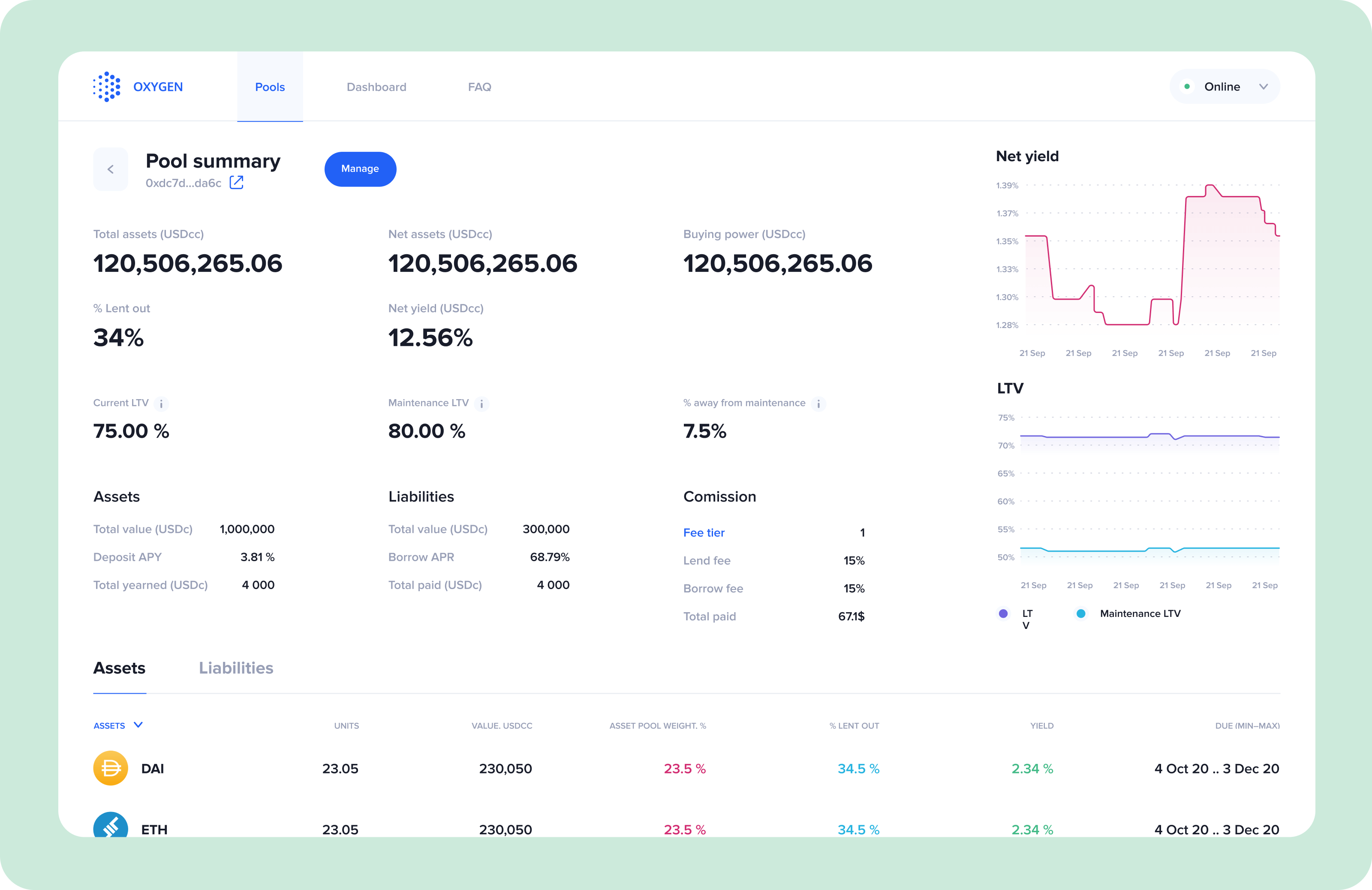

Pool Summary

In the Pool Summary tab, you will a number of high-level data points relating to your Pool.

Total Assets

The total amount of Assets in USDc held for deposit or lent out in USDc for this Pool.

Borrowed Assets (Liabilities)

The total amount of borrowed Assets in USDc in USDc for this Pool.

Net Assets

Total Assets (Total Deposits plus Total Loans) minus Total Debt (Total Borrowings) in USDc for the Pool

Buying Power

Buying Power is the maximum amount of equity available to borrow tokens.

Buying Power gives you additional leverage to borrow additional assets, increasing your access to assets but also increasing your risk.

Buying Power = Total Value of Assets * Initial LTV - Value of Debt = Total Value of Assets * (Initial LTV – Current LTV)

% Lent Out

This is the % amount of Assets in this Pool that have been lent out.

Yield

This is the amount of compound interest accruing for this Pool over a given period of time (daily, weekly, monthly, …). Borrowings accrue negative interest and offset earnings from Loans.

Current LTV

LTV or Current LTV is the total amount of Debt (i.e. Borrowings) as a percentage of Total Assets (Assets plus Lending Amounts).

The formula is CLTV = Sum(DEBT_i) / (ASSET_i + IOU_i) for each Asset i in the Pool.

Initial LTV

The Initial Loan-To-Value is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to take a new position (or after the Maintenance LTV resets).

Maintenance LTV

The Maintenance Loan-To-Value is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to maintain an existing position.

The Maintenance LTV applies for a certain number of hours (currently this is [24] hours) during which the Current LTV may be above the Initial LTV. At the end of the time period, the margin needs to be back down to the Initial LTV.

% Away from Maintenance

% Away from Maintenance LTV means by what % value of Assets needs to fall by to trigger Maintenance LTV (keeping value of Liabilities fixed in USDc).

% Away = (Total Assets - (Total Debt/Maintenance LTV))/Total Assets

Deposit APR

Annual interest rate for deposits.

Borrow APR

Annual interest rate for borrowing.

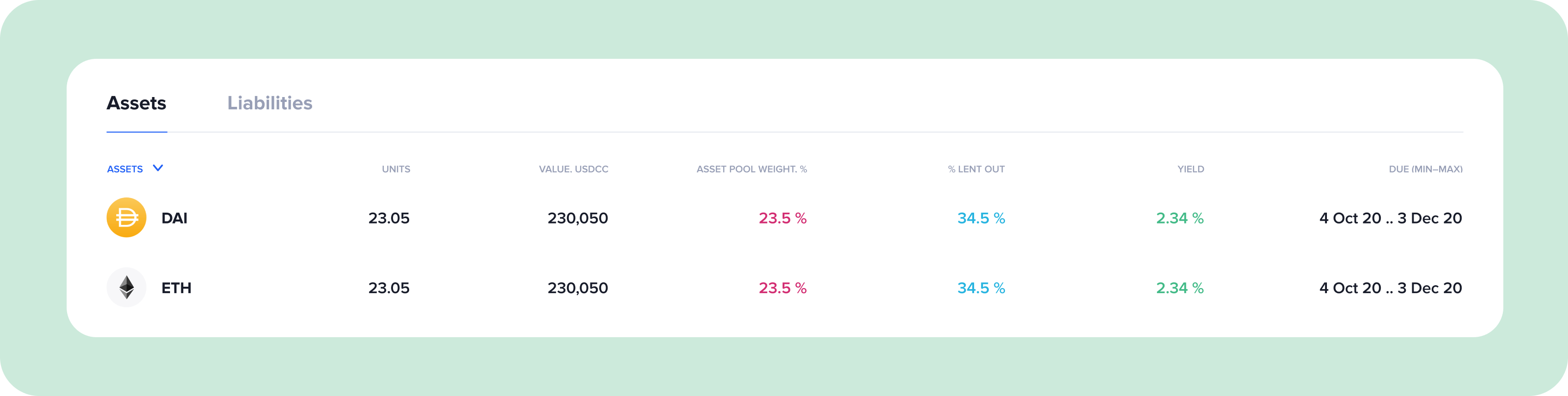

Assets

The Pool Summary Asset tab shows the amount of tokens lent for each type of asset including other key data. In the example above, the User borrowed 23.05 ETH at a value of 230,050 USDc which represents 23.5% of the Liabilities in the Pool and has an LTV of 34.5%. The interest rate payable for this loan is 2.34% and the loan can be repaid any time between 4 October 2020 and 3 December 2020.

Units

The number of tokens held.

Value

The value of the Asset in USDc.

Asset Pool Weight %

This is the percentage amount that a given Asset represents of the Assets for a given Pool.

% Lent Out

This is the % amount of holdings in this Asset that have been lent out.

Yield

Annual compounded interest rate for lending.

Term of Borrow (should be Loan)

This is the date when the loan can be redeemed but otherwise it will roll automatically.

Current LTV

LTV or Current LTV is the total amount of Debt (i.e. Borrowings) as a percentage of Total Assets (Assets plus Lending Amounts).

The formula is CLTV = Sum(DEBT_i) / (ASSET_i + IOU_i) for each Asset i in the Pool.

Initial LTV

The Initial Loan-To-Value is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to take a new position (or after the Maintenance LTV resets).

Maintenance LTV

The Maintenance Loan-To-Value is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to maintain an existing position.

The Maintenance LTV applies for a certain number of hours (currently this is [24] hours) during which the Current LTV may be above the Initial LTV. At the end of the time period, the margin needs to be back down to the Initial LTV.

% Away from Maintenance

% Away from Maintenance LTV means by what % value of Assets needs to fall by to trigger Maintenance LTV (keeping value of Liabilities fixed in USDc).

% Away = (Total Assets - (Total Debt/Maintenance LTV))/Total Assets

Deposit APR

Annual interest rate for deposits.

Borrow APR

Annual interest rate for borrowing.

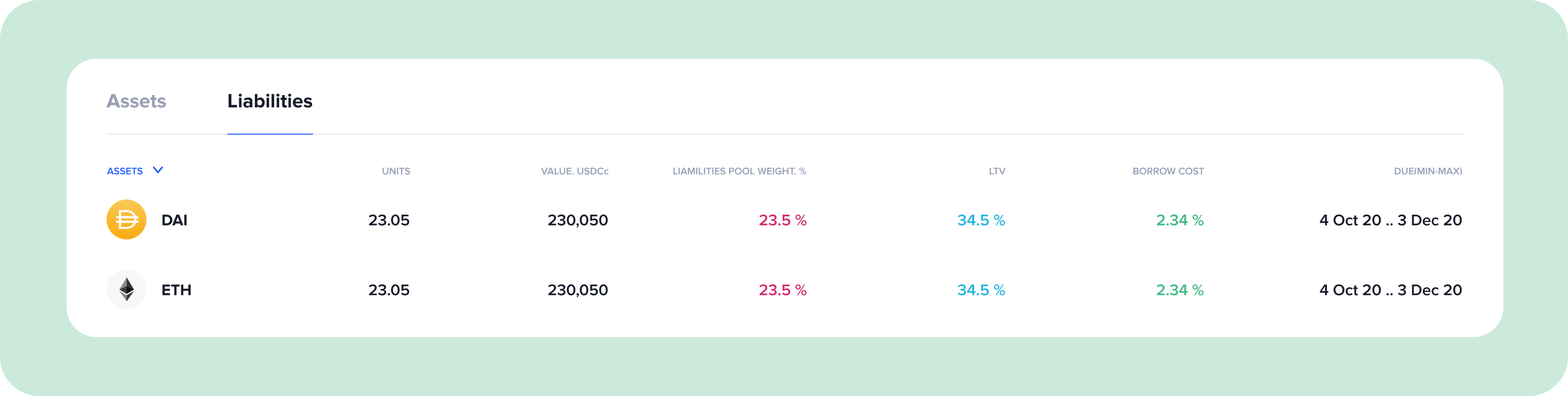

Liabilities

The Liabilities tab shows the amount of tokens borrowed for each type of asset including other key data. In the example above, the User borrowed 23.05 ETH at a value of 230,050 USDc which represents 23.5% of the Liabilities in the Pool and has an LTV of 34.5%. The interest rate payable for this loan is 2.34% and the loan can be repaid any time between 4 October 2020 and 3 December 2020.

Units

The number of tokens borrowed.

Value

The value of the borrowed funds in USDc.

Liabilities Pool Weight %

This is the percentage amount that a given Loan represents of the total Liabilities for a given Pool.

LTV (for a given Asset)

LTV or Current LTV is the amount of Debt (i.e. Borrowings) for this Asset as a percentage of total holdings for this Asset (Assets plus Lent Amounts).

The formula is LTV = Sum(DEBT) / (ASSET + IOU) for a given Asset in the Pool. Note that the LTV of a given Asset can exceed the Maintenance LTV of the Pool so long as the weighted average LTV of the Assets in the Pool remains at or below the Maintenance Margin.

Borrow Cost

Annual interest rate for borrowing.

Duration (Min-Max)

This is the date window during which the loan may be repaid.

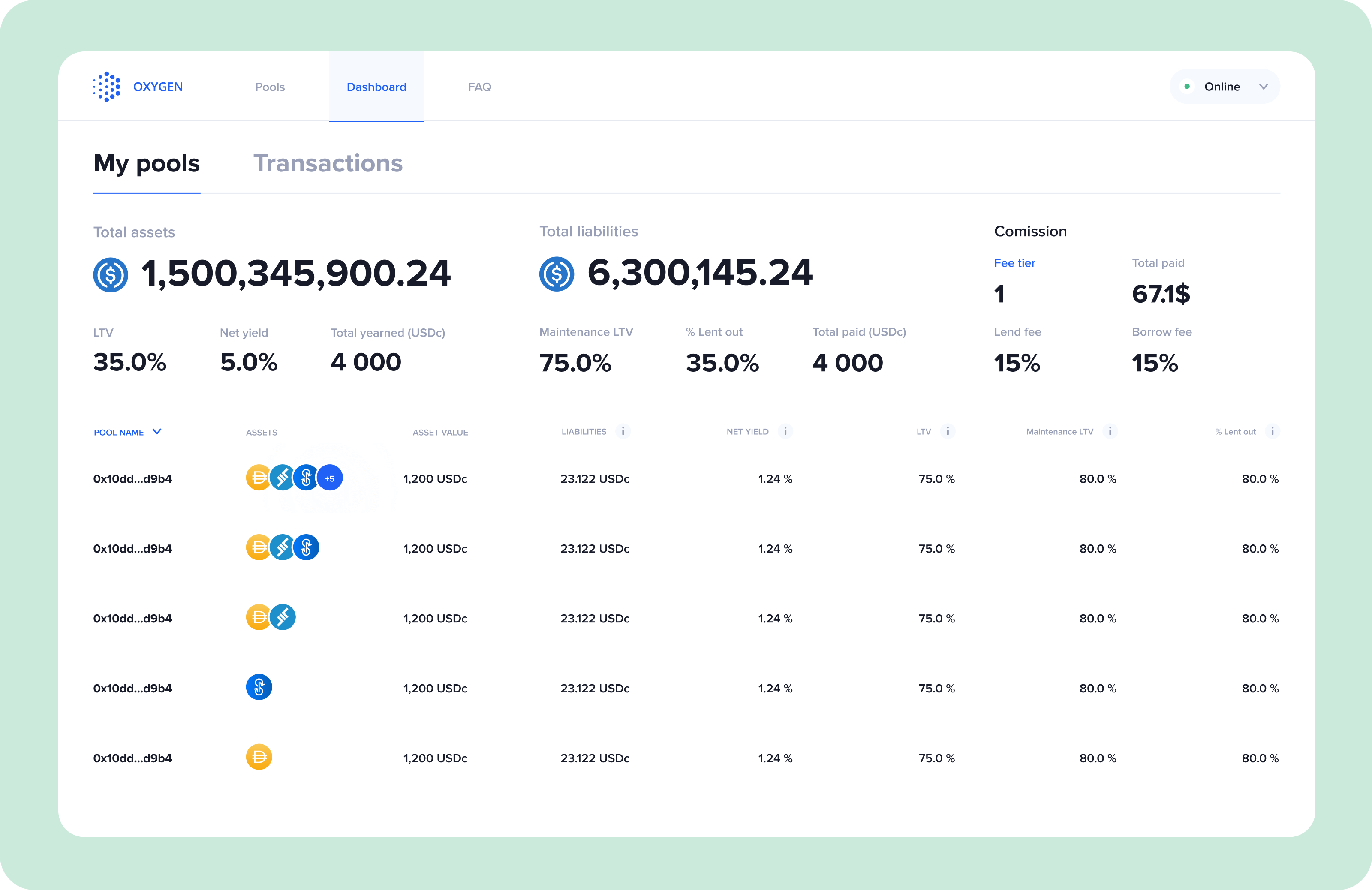

Dashboard

This screen shows the overview of all the Pools belonging to a given User, the assets in each Pool and some high level KPIs.

Overall KPIs include the following summary values for the User include all Pools:

Total Assets

This represents the total amount of Assets held for deposit or lent out in USDc for all Pools owned by the User.

Total Liabilities

This represents the total amount of Debt (=Borrowings) in USDc for all Pools owned by the User.

Net Yield

This is the amount of interest accruing on a given Pool over a given period of time (daily, weekly, monthly, …). Borrowings will accrue negative interest and offset earnings from Lending.

LTV

LTV or Current LTV is the total amount of Debt (i.e. Borrowings) as a percentage of Total Assets (Assets plus Lending Amounts).

The formula is CLTV = Sum(DEBT_i) / (ASSET_i + IOU_i) for each Asset i in the Pool.

Maintenance LTV

The Maintenance Loan-To-Value for the Pool is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to maintain an existing position.

The Maintenance LTV applies for a certain number of hours (currently this is [24] hours) during which the Current LTV may be above the Initial LTV. At the end of the time period, the margin needs to be back down to the Initial LTV.

Max LTV

This is LTV over which liquidation/rebalancing of your Pool will start. It may be slightly higher than Maintenance LTV to give you time to adjust your portfolio for a short period of time (for example [4] hours). This is future functionality and but will be available soon. In the meantime, Max LTV is the same as Maintenance LTV.

Total Assets (Assets held for Deposit and Lent Out) and Total Liabilities (Total Borrowings).

The Columns shown above are as follows:

Pool Name

The Pool Name is the Address of a Smart Contract representing the Pool of Assets. It will only be accessible to the User who created it for a Private Pool.

Assets

Icons representing the tokens contained in the Pool.

Ownership

The percentage of a given Pool that the given User owns. For a Private Pool this will always be 100%.

Asset Value

This represents the total amount of Assets held for deposit or lent out in USDc for the given Pool.

Liabilities

This represents the total amount of Debt (=Borrowings) in USDc for the given Pool.

Net Yield

This is the amount of interest accruing on a given Pool over a given period of time (daily, weekly, monthly, …). Borrowings will accrue negative interest and offset earnings from Lending.

LTV

LTV or Current LTV is the total amount of Debt (i.e. Borrowings) as a percentage of Total Assets (Assets plus Lending Amounts).

The formula is CLTV = Sum(DEBT_i) / (ASSET_i + IOU_i) for each Asset i in the Pool.

Maintenance LTV

The Maintenance Loan-To-Value is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) in order to maintain an existing position.

The Maintenance LTV applies for a certain number of hours (currently this is [24] hours) during which the Current LTV may be above the Initial LTV. At the end of the time period, the margin needs to be back down to the Initial LTV.

Max LTV

This is LTV over which liquidation/rebalancing of your Pool will start. It may be slightly higher than Maintenance LTV to give you time to adjust your portfolio for a short period of time (for example [4] hours). This is future functionality and but will be available soon. In the meantime, Max LTV is the same as Maintenance LTV.

By pressing on Deposit you can add Assets to a given Pool and likewise by selecting Withdraw, you can withdraw some Assets.

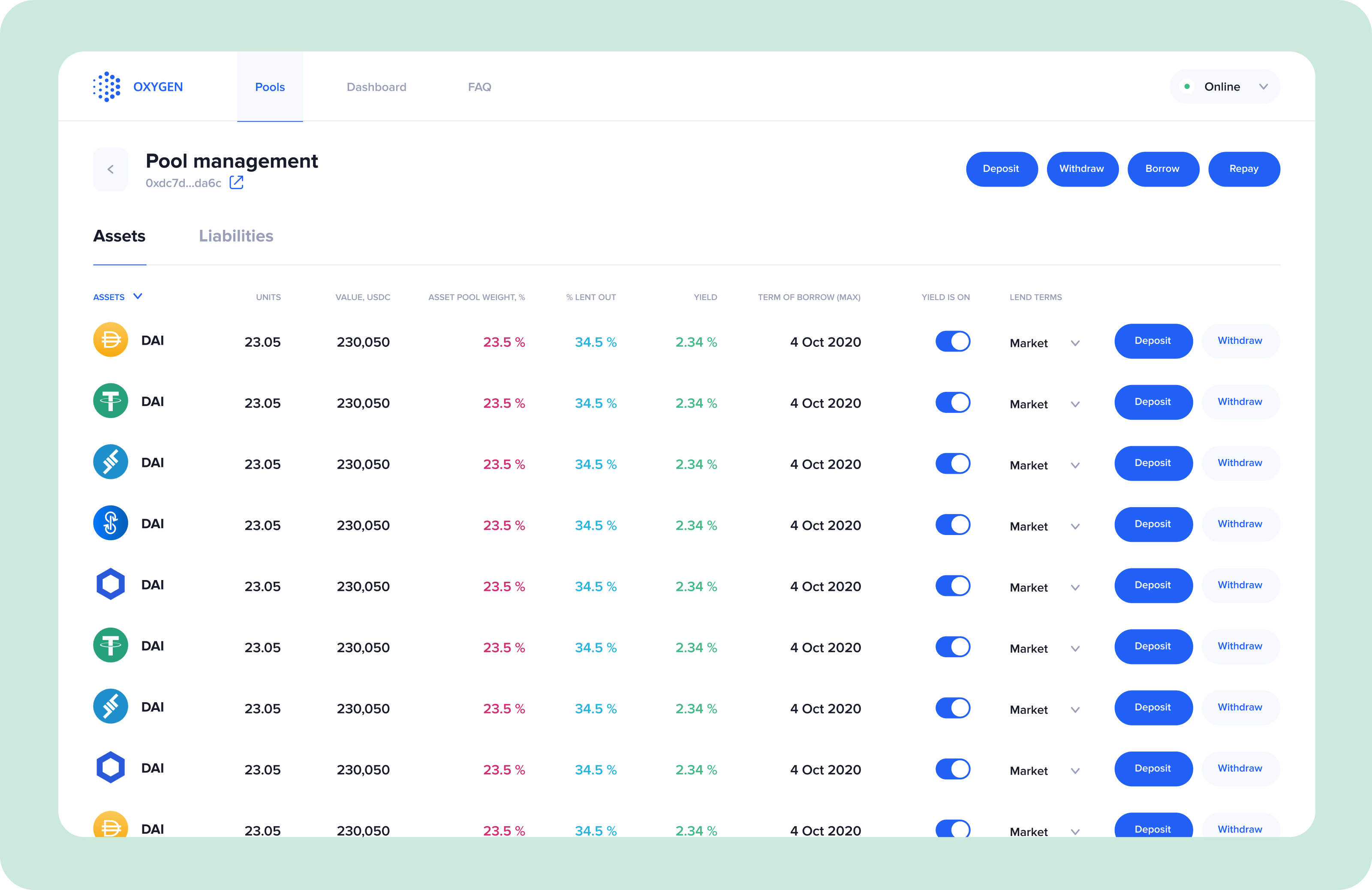

Pool Detail

Assets

In the Pool Management Assets tab, you will a detailed breakdown of the Assets (tokens held and lent out) in the Pool. The fields displayed are as follows:

Asset

The token or coin held in the Pool

Units

The number of tokens of the given Asset held.

Value

The value of the Asset in USDc.

Asset Pool Weight %

This is the percentage amount that a given Asset represents of the Assets for a given Pool.

% Lent Out

This is the % amount of this Assets for this Pool that have been lent out.

Yield

Annual interest rate for lending.

Term of Borrow (should be Loan)

This is the date when the loan can be redeemed but otherwise it will roll automatically.

Yield is On

This radio button is turned on when the Asset is available to act as collateral and earn yield.

Lend Terms

This field determines the terms under which you are willing to lend this Asset. It can either be Market (whatever the market determined APY is by the orderbook) or Limit where you specify the Minimum Rate (APY) that you would accept for this Asset in this Pool.

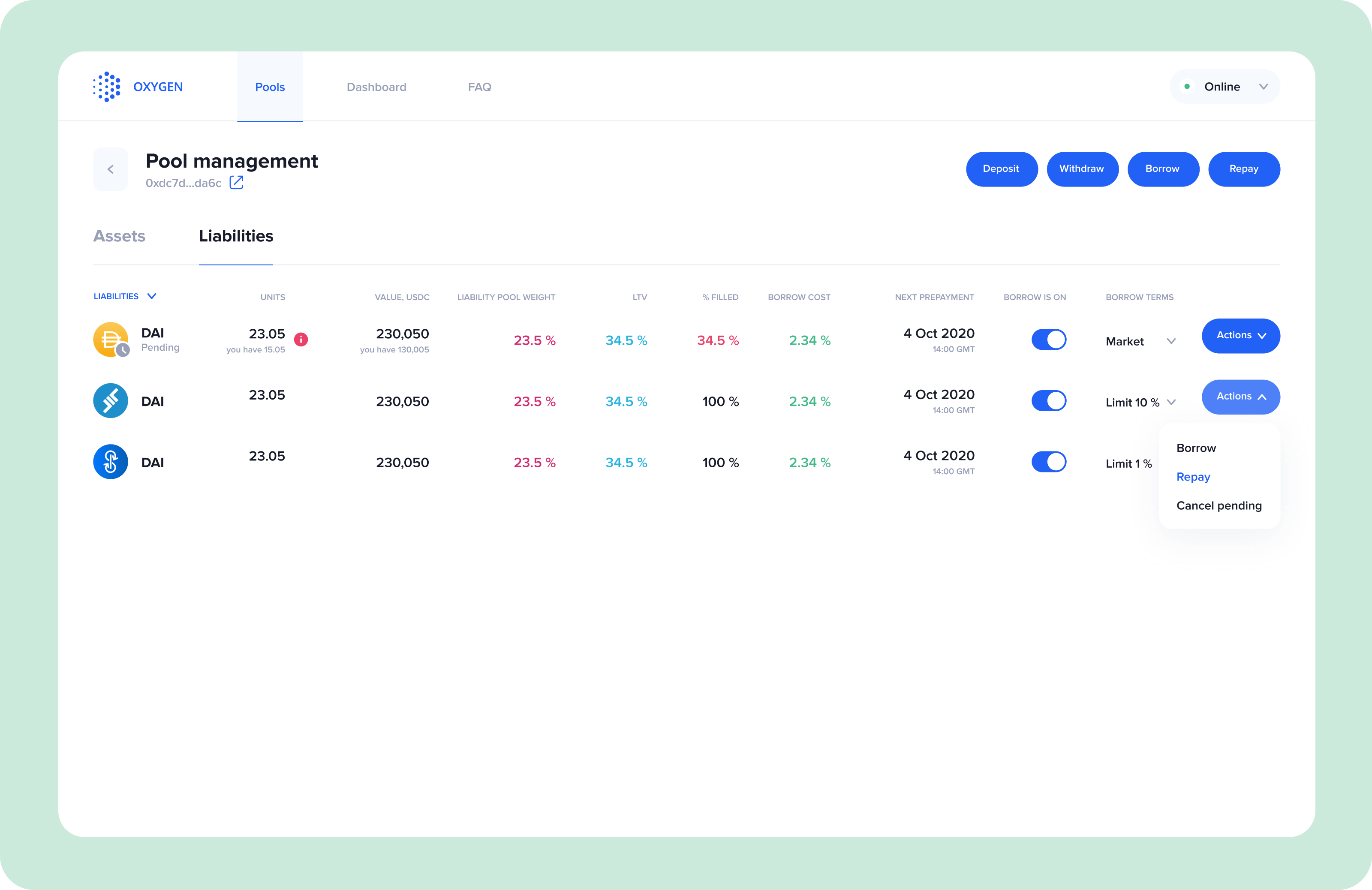

Liabilities

In the Pool Management Liabilities tab, you will a detailed breakdown of the Liabilities (borrowed assets) in the Pool. The fields displayed are as follows:

Asset

The token or coin held in the Pool

Units

The number of tokens of the given borrowed Asset held.

Value

The value of the borrowed Asset in USDc.

Liabilities Pool Weight %

This is the percentage amount that a given Loan represents of the Liabilities for a given Pool.

LTV (for a given Asset)

LTV or Current LTV is the amount of Debt (i.e. Borrowings) for this Asset as a percentage of total holdings for this Asset (Assets plus Lent Amounts).

The formula is LTV = Sum(DEBT) / (ASSET + IOU) for a given Asset in the Pool.

% Filled

This represents the percentage of Borrowing Trades which have been filled (in other words, there is a Lender willing to lend the Asset at the specified rate (or better) if set to Limit or at any rate if set to Market).

Borrowing Cost

Annual interest rate for borrowing.

Next Prepayment

This is the date when the loan can be redeemed but otherwise it will roll automatically.

Borrow is On

This radio button is turned on to indicate when an Asset is borrowed.

Borrow Terms

This field determines the terms under which you are willing to borrow this Asset in this Pool. It can either be Market (whatever the market determined APR is by the orderbook) or Limit where you specify the Maximum Rate (APR) that you would be willing to pay.

Depending on what you select, your request to borrow will be matched with offers to lend in the orderbook.

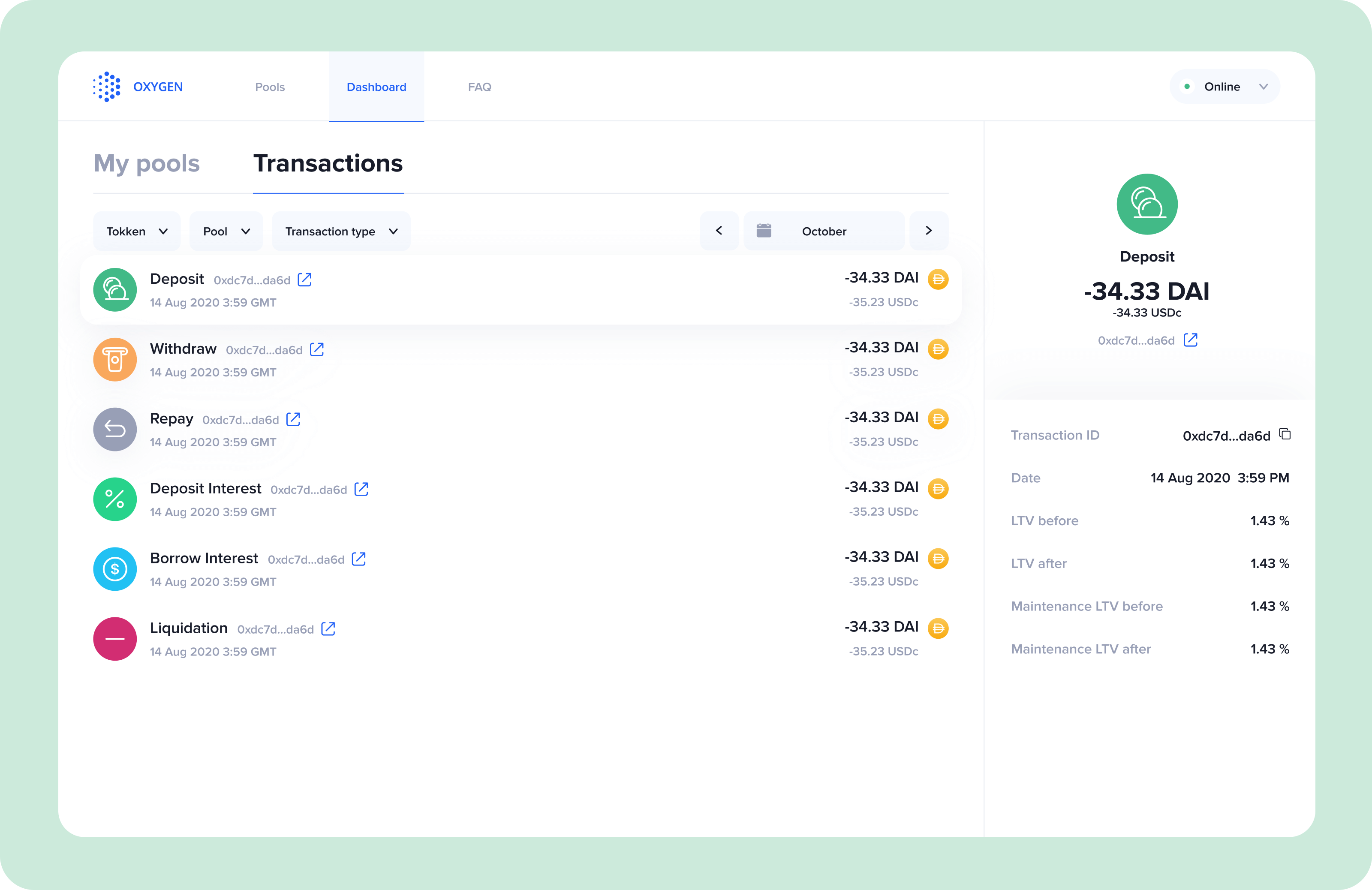

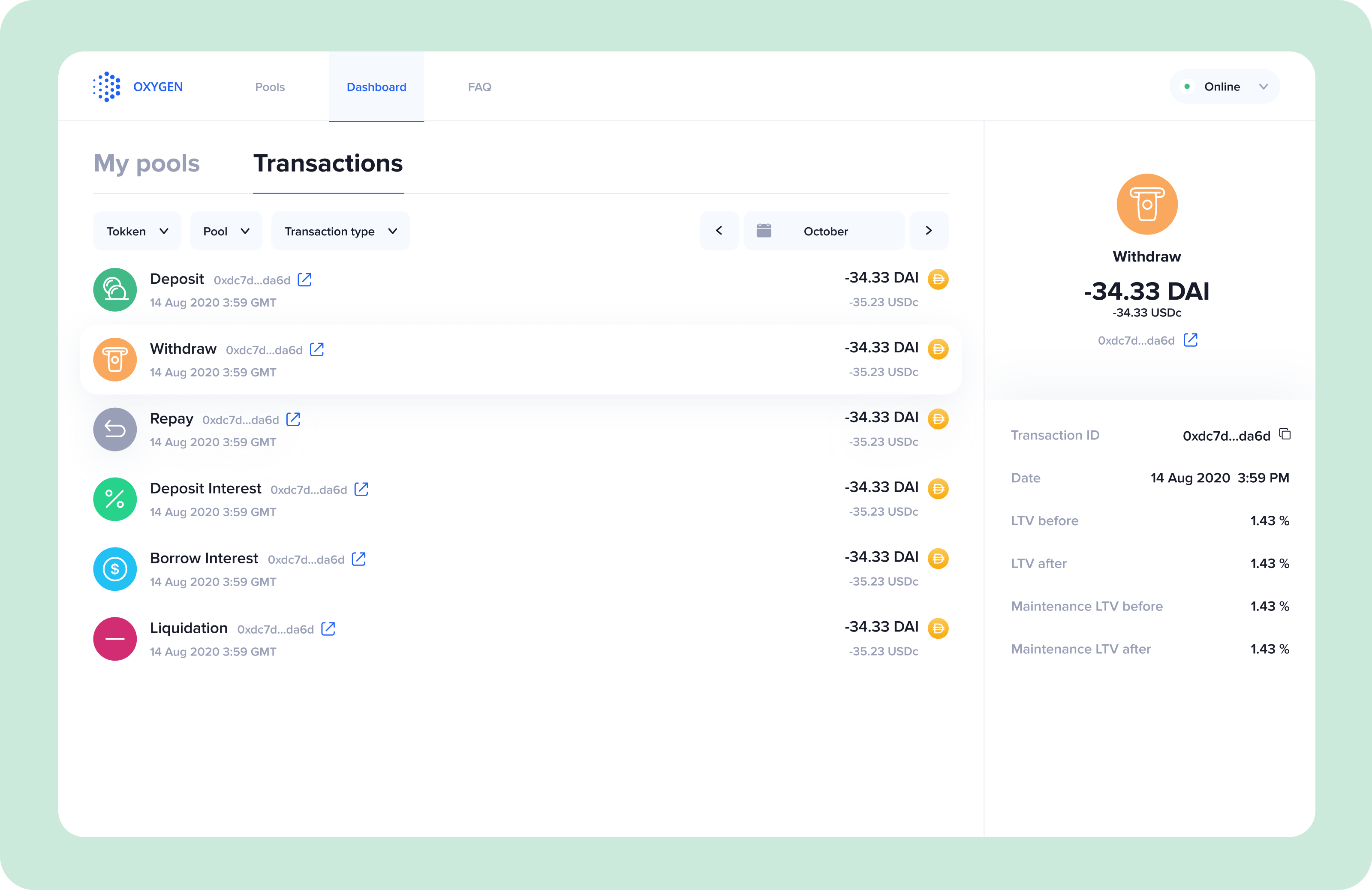

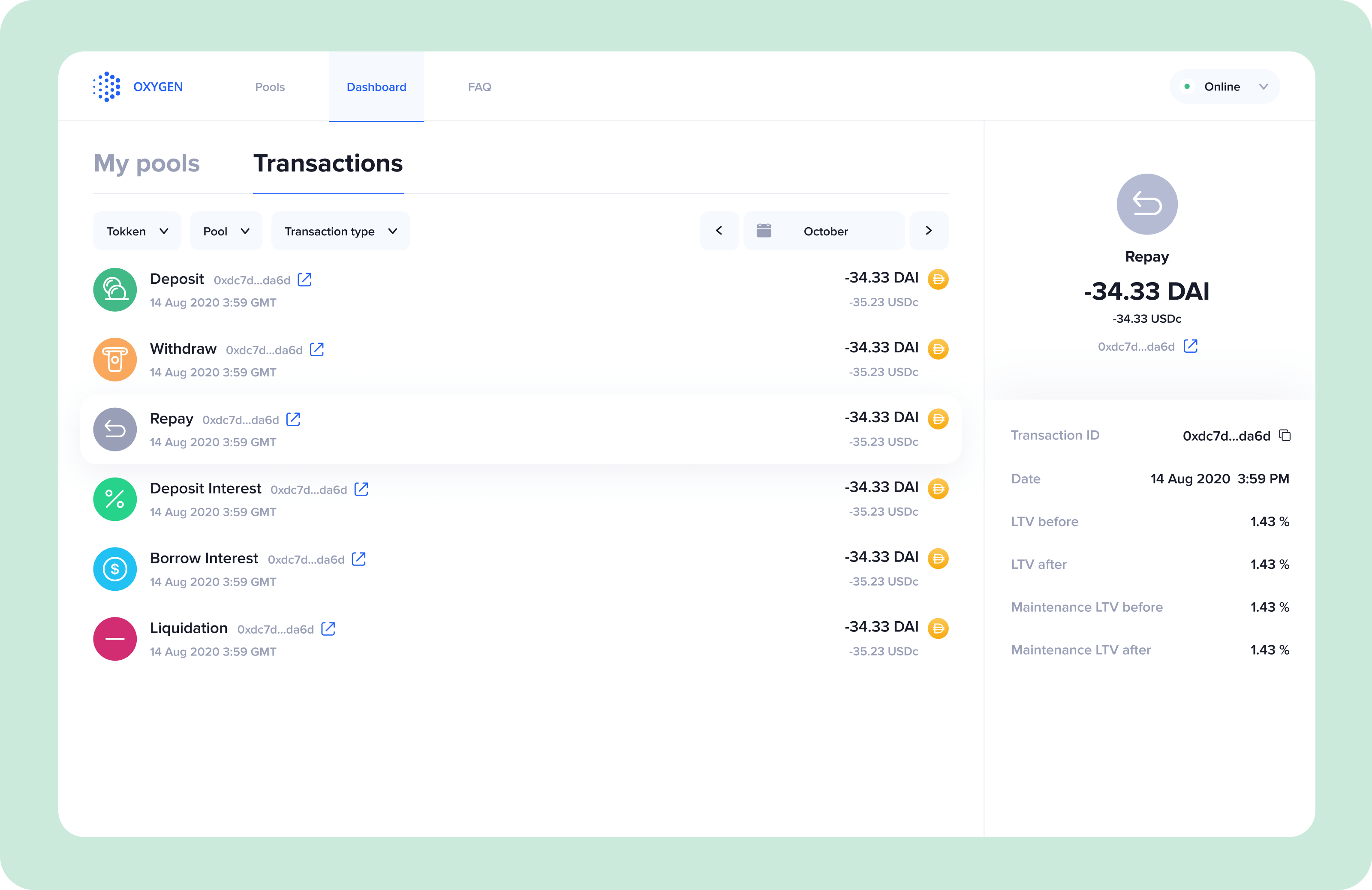

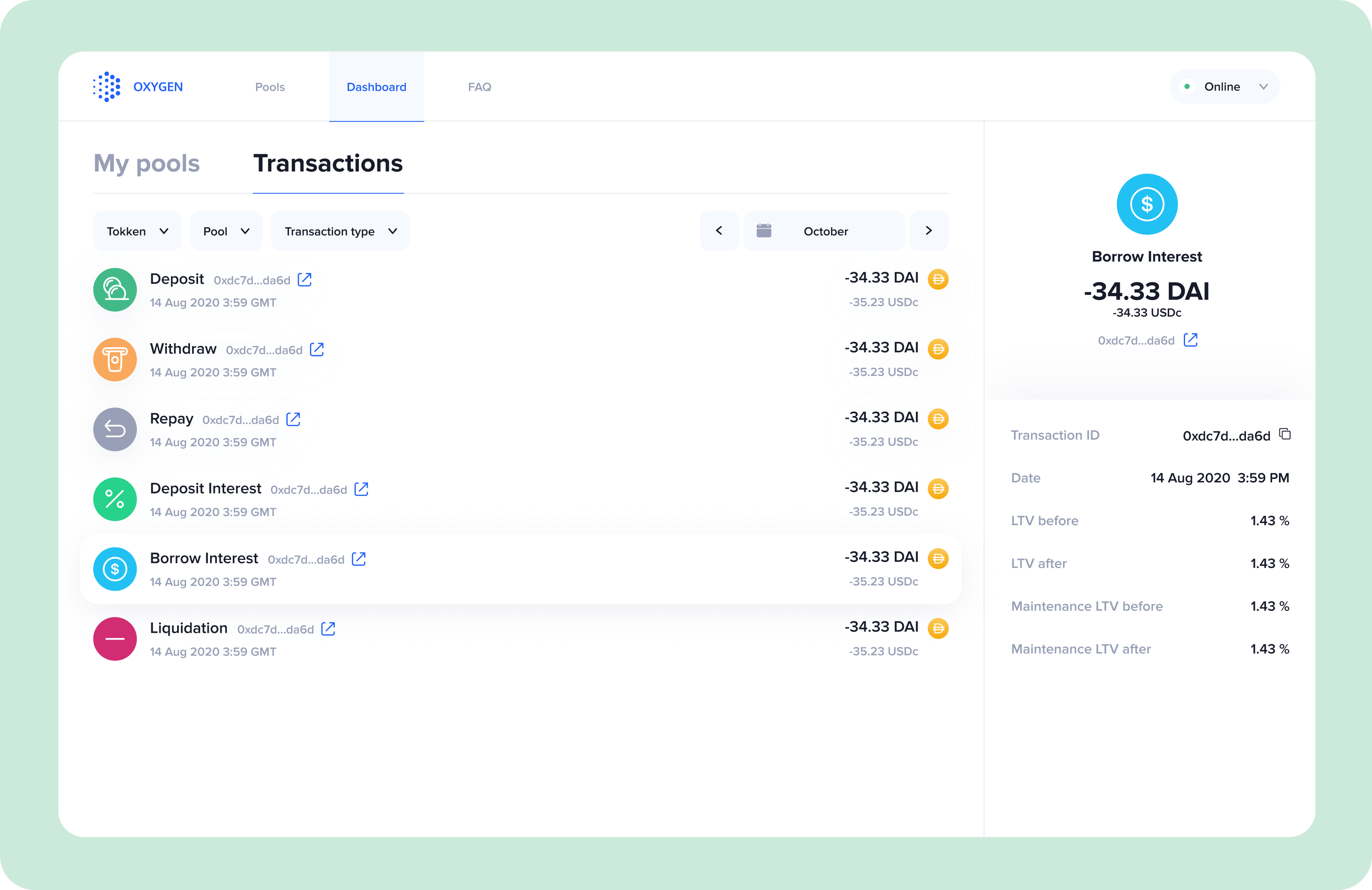

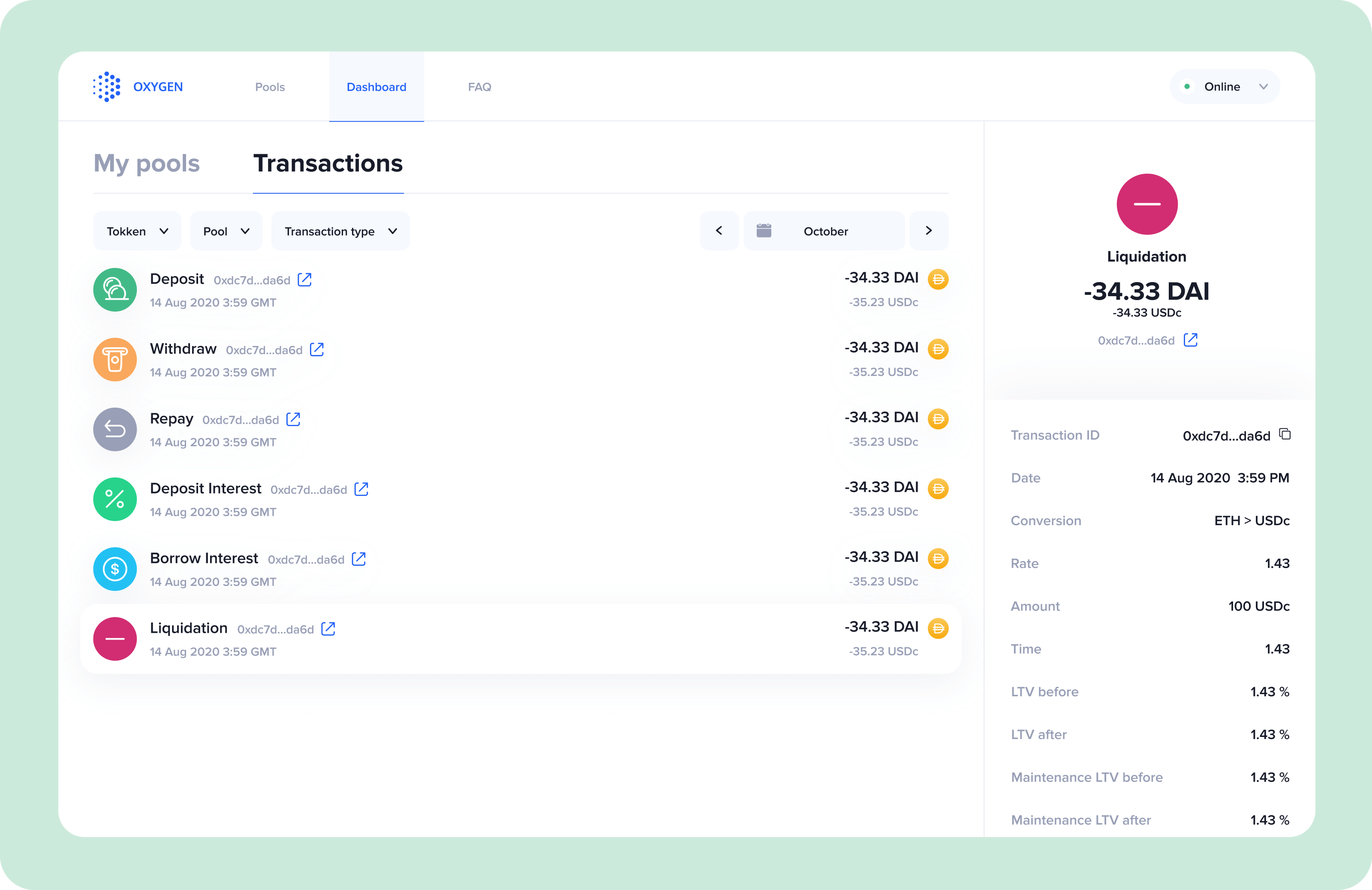

Transactions

There is an audit trail of all transactions. Each transaction made regardless of type will show the following fields:

Transaction ID

This shows the blockchain transaction code so the specific transaction can be traced.

Timestamp

The exact date and time when a transaction occurred.

Liabilities Pool Weight %

This is the percentage amount that a given Loan represents of the Liabilities for a given Pool.

LTV Before

The LTV or Current LTV of the Pool PRIOR to the Transaction being executed. This is calculated by taking the total amount of Debt (i.e. Borrowings) as a percentage of Total Assets (Assets plus Lending Amounts).

The formula is CLTV = Sum(DEBT_i) / (ASSET_i + IOU_i) for each Asset i in the Pool.

LTV After

The LTV or Current LTV of the Pool AFTER the Transaction was executed.

Maintenance LTV Before

The Maintenance LTV of the Pool PRIOR to the Transaction being executed. This ratio is the maximum allowable amount of Debt as a percentage of Total Assets (Asset Tokens plus Lending Amounts) without requiring additional Equity to be added to the Pool either through adding Assets or reversing loans.

The Maintenance LTV applies for a certain number of hours (currently this is [24] hours) during which the Current LTV may be above the Initial LTV. At the end of the time period, the Current LTV needs to be back down to the Initial LTV.

Maintenance LTV After

The Maintenance LTV of the Pool AFTER the Transaction was executed.

Liquidation

This shows the Transaction audit trail for a Liquidation transaction. This transaction type is different than the other types of Transaction. There are 2 additional fields for Liquidations:

Conversion

This field displays the conversion that took place in order to exercise the liquidation. In this case ETH was converted to USDc.

Rate

The Rate field displays the exchange rate used for the conversion.